extended child tax credit payments 2022

New research shows a permanently expanded child tax credit could bring benefits 10 times greater than its costs. Prior to 2021 the Child Tax Credit maxed out at 2000 per child and was only partially refundable.

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

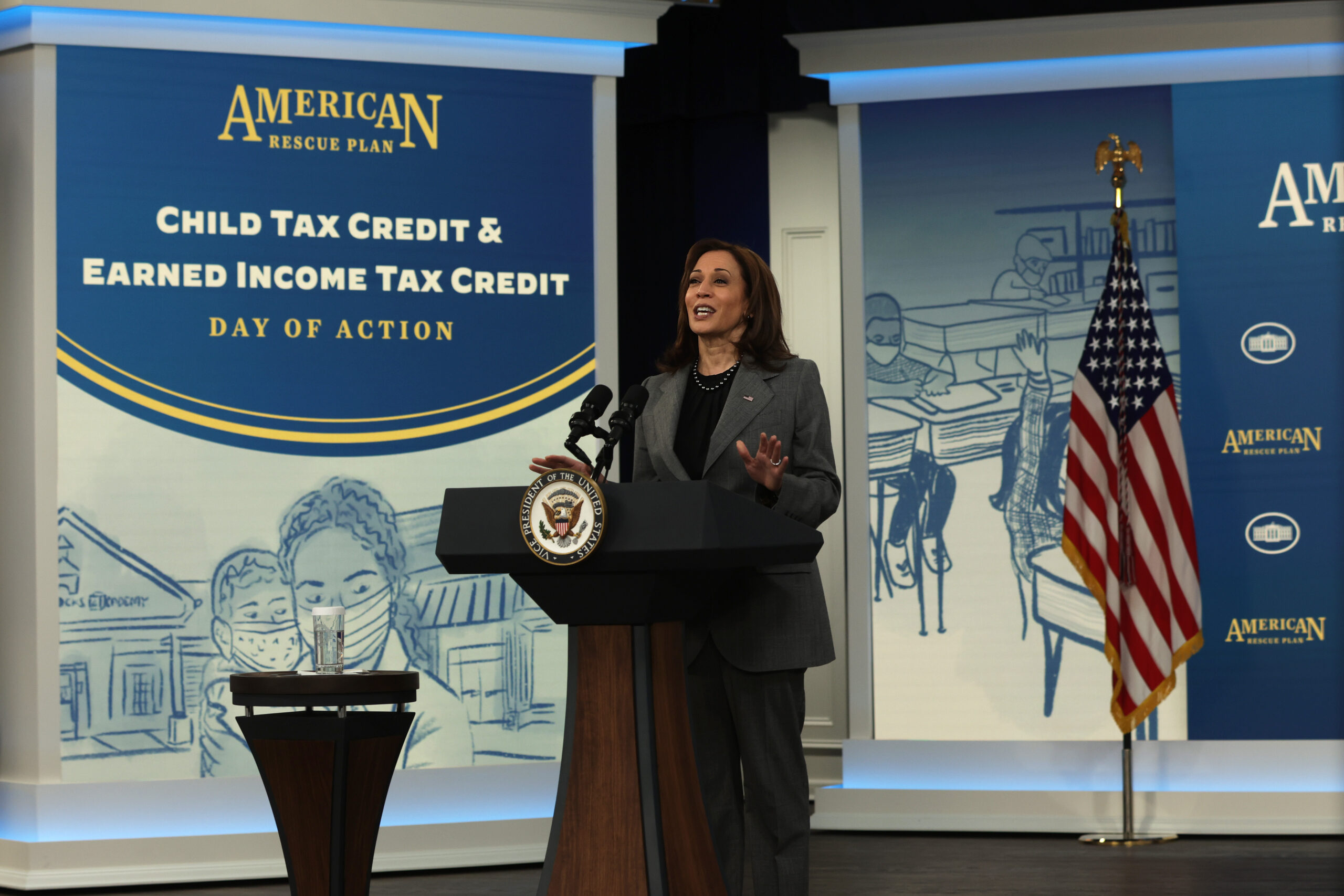

Earned Income Tax Credit.

. Therefore child tax credit payments will NOT continue in 2022. The thresholds for monthly. As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there will be no advance payments offered to families.

As part of the 2017 tax overhaul Congress doubled the existing child tax credit to 2000 per child under age 17 at year-end. Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan. Most of the eligible families will still qualify for the standard CTC of 2000 per child going into 2022 but the monthly advance payments will cease.

For parents who opted out of the advanced child tax credit payments in 2021 they will be able to claim the full credit if they qualify on their 2021 tax return. Washington lawmakers may still revisit expanding the child tax credit. 15 rounding out a six-month series of checks that supported an estimated 61 million American kids.

Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. There are no more advance monthly payments 17-year-olds no longer qualify for the credit and parents or guardians will now need to file a tax return to receive the credit next. But others are still.

Here is what you need to know about the future of the child tax credit in 2022. However for 2022 the credit has reverted back to 2000 per child with no monthly payments. How Expansion Could Eliminate Poverty for Millions.

The final advance child tax credit payment for 2021 is set to hit bank accounts on Dec. Government disbursed more than 15 billion of monthly child tax credit payments in July. Businesses and Self Employed.

Congress fails to renew the advance Child Tax Credit payments which would have been part of the Build Back Better Act and the payments expire. Under the BBB spending plan the current expanded Child Tax Credit will be extended for another year bringing the total amount paid over 2 years to a maximum of. That meant if a household claiming the credit owed the IRS no money it.

Making the credit fully refundable. Now if the current payment amounts do not pass in Congress moving forward eligible parents can only receive a once-a-year maximum credit per child come tax time -- 1000 for school-age children and. The Child Tax Credit provides money to support American families.

FAMILIES have grown used to monthly 300 payments through the expanded child tax credit but in February 2022 theres a chance the long-awaited extension could double payments. Here is some important information to understand about this years Child Tax Credit. For the first time since July families are not expected to receive a 300 payment on January 15 2022.

However Congress had to vote to extend the payments past 2021. Under the Build Back Better Act you generally wont receive monthly child tax credit payments in 2022 if your 2021 modified AGI is too high. Parents of younger children saw 300 per month while parents of older.

The irs child tax. Any Hope Of Receiving A Child Tax Credit Payment In January 2022 Is Slowly Slipping Away As Congress Holds The Key To More Money For Americans. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to.

It is a dollar-for-dollar reduction in taxes that a range. 2022 Child Tax Credit. The American Rescue Plan was passed in Congress in 2021 with this increasing the amount that eligible American families could receive from their Child Tax Credit payments.

The final advance child tax credit payment for 2021 is set to hit. Families saw the first half of the credit spread out in six payments from July through Dec.

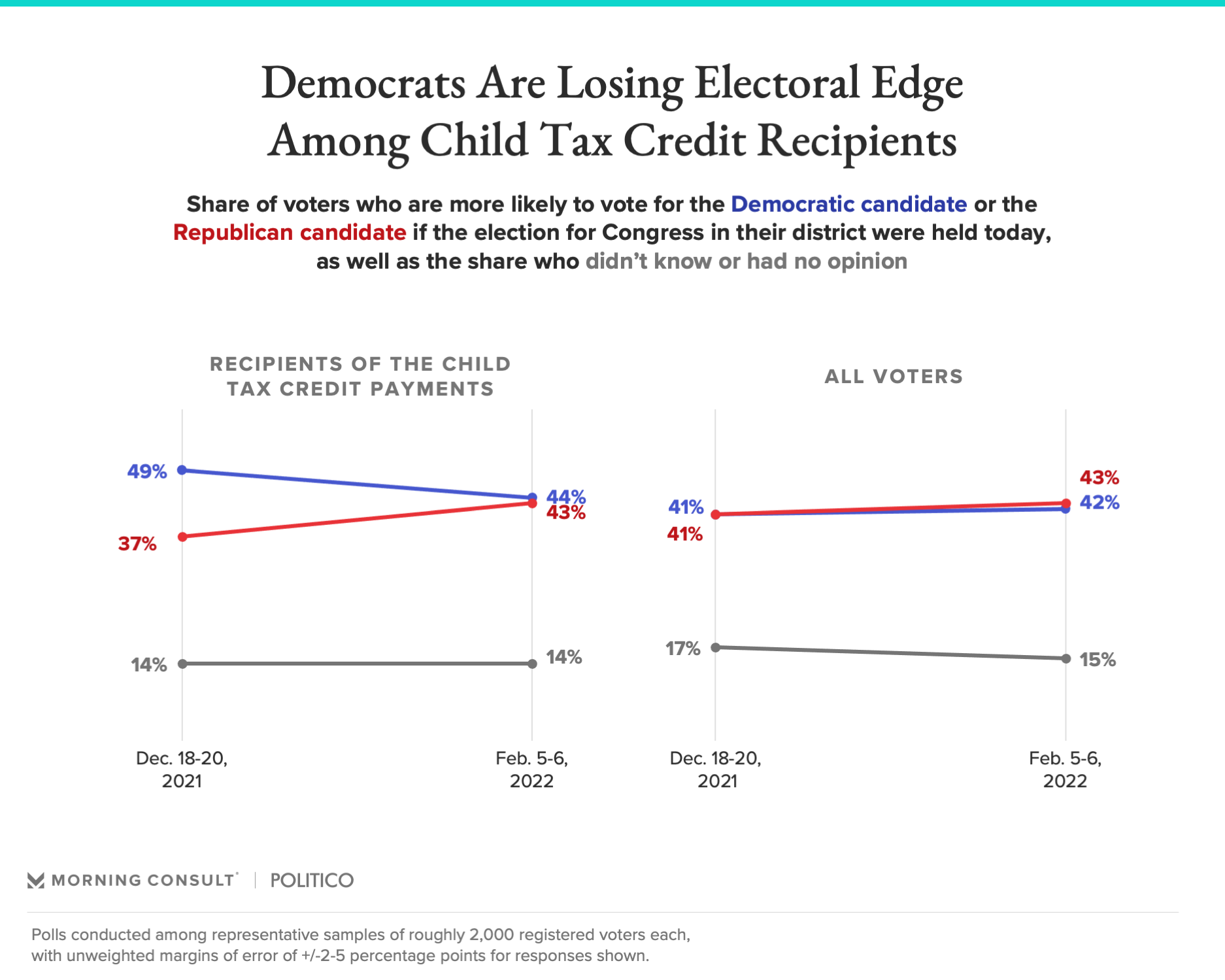

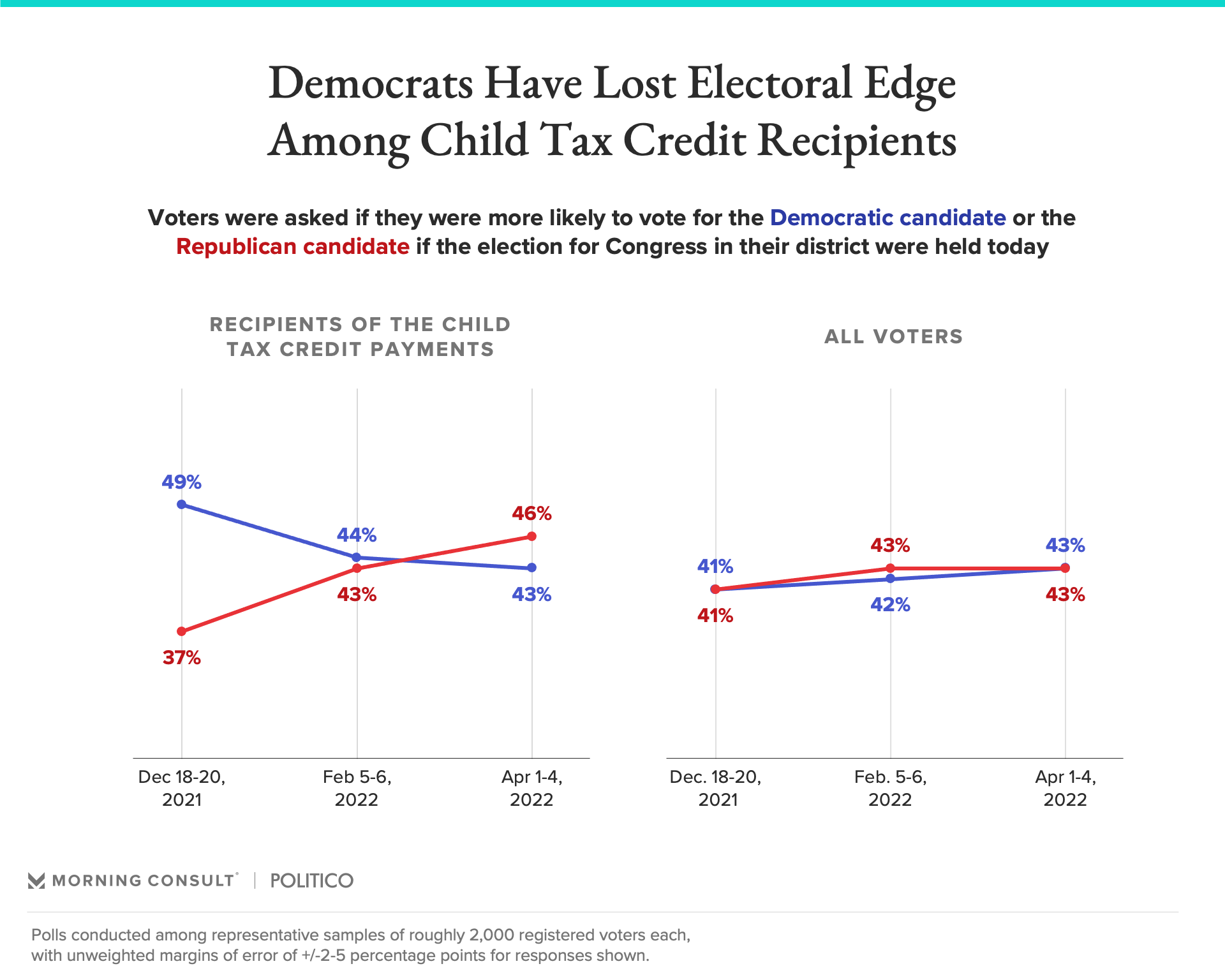

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

When Are Taxes Due In 2022 Forbes Advisor

Stimulus Check Update These Families Will Get 3 600 In 2022 Katv

What To Know About The Child Tax Credit The New York Times

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

2022 Irs Tax Refund Dates When To Expect Your Refund Cpa Practice Advisor

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Child Tax Credit Is Expanded Child Tax Credit Dead Did It Help Deseret News

What Families Need To Know About The Ctc In 2022 Clasp

Republicans Favored To Win Senate Among Child Tax Credit Recipients

Make A Smart Investment Today For Your Tomorrow In 2021 Solar Power Energy Investing Energy

Will There Be Another Child Tax Credit Check In April Fingerlakes1 Com

Gauging The Impact Of The Expanded Child Tax Credit S Expiration